What is it?

The purpose of a life insurance policy is to provide financial stability for your family in the event of your death. As a result, even with the normally low rates, a life insurance policy is not something to skimp on. A life insurance policy is essentially a contract between you and an insurance provider. You pay premiums in exchange for a lump sum payment to your named beneficiaries if the insured person passes away.

A death benefit is the term used to describe this payment. Plans are typically chosen based on the insured’s interests, needs, and aspirations. While death benefits are often tax-free, consider your style of life and the financial circumstances you’d wish your loved ones to be in if you were to pass away. When choosing a life insurance policy, consider factors like burial costs, final medical bills, relocation costs, daycare, college funds, ongoing mortgage payments and more.

This is why you need Life Insurance

You may or may not require life insurance, depending on your circumstances. If you’re a single person or live in a family with no dependents, you won’t need much in the way of life insurance. You may only need a small savings account set up for funeral fees and a completed will to prepare for a tragedy. You could also get insurance to pay your property’s estate taxes. This ensures that heirs don’t have to liquidate their assets.

This is only required if you have established a sizable estate. On the other hand, if you’re the sole breadwinner for a large family with minimal money, you’ll need a lot of coverage. If you find yourself in this circumstance, it’s critical that you set spending priorities.

There are three main types of life insurance policies

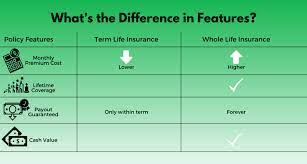

They are term life policies, universal life policies and whole life policies. Each type of policy varies when compared with the other.

Term life insurance

From a financial aspect, policies are designed to provide protection for a set period of time. These plans are typically 10 to 20 years in length. Premiums are usually guaranteed and remain constant throughout the term. Furthermore, most term life premiums are lower than whole life premiums. The proceeds from a term life payout are intended to compensate for lost income during working years.

Universal life insurance

Universal life insurance is a sort of permanent life insurance designed to offer coverage for the rest of one’s life. Unlike whole life insurance, universal policies allow you to adjust your premiums and coverage amounts at any time during your life. The majority of people use universal life insurance to protect money that will be passed down to beneficiaries. There is always a tax-deferred opportunity.

Whole life insurance

Whole life insurance policies are designed to offer coverage for the rest of one’s life. Premiums for these policies are often greater than for other types of life insurance, but they are set and not adjustable. Whole life insurance frequently has a monetary value. As a result, insurance have a savings component. Over time, this component may accrue tax-deferred. Many people utilize complete life plans for estate planning as well.

Determine How Much Coverage You Need

A number of factors will influence the amount of life insurance you require. Each individual will be unique. After deciding on the sort of life insurance you require (term, universal, or whole), you must decide on the quantity of coverage. The level of coverage you choose determines how much will be paid to your beneficiaries if you (the insured party) die.

While there are other elements to consider, the following are some of the more prevalent and important: Your potential earnings, Your valuables Liabilities and debts, Existing insurance coverage and Other expenses that your family can face. After you’ve decided on the amount of coverage you think you’ll need, keep in mind that you should review and maybe adjust your life insurance policy after each big life event.

Final Expense Life Insurance

Burial costs can quickly mount depending on what is required to complete the arrangements. While life insurance is typically used to replace lost income, final expense life insurance is designed to cover the costs of burying your loved ones. It serves a more specific purpose, which is to cover all of the costs of burying a family member, both little and huge, including earlier medical expenditures.

The policy also does not require a health checkup for qualifying, with the only objective of ensuring that everyone can have a proper burial. It’s similar to guaranteed-issue life insurance in this regard, and it only requires assent. When used in conjunction with a reputable funeral home, these insurance can automatically release funds to pay the expense of the funeral. No one should be forced to spend their money.