In a nutshell, Original Medicare is a federally financed health insurance program for people aged 65 and up who meet certain criteria.

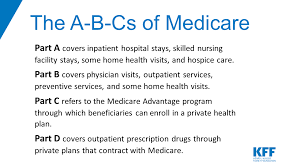

In Medicare there two parts of the insurance which includes: Part A, which is the hospital insurance, and Part B which is the medical insurance which also covers 80% of medical expenses after the deductible is met and most people are automatically enrolled on their 65th birthday. Most Americans are eligible on their 65th birthday and some people are eligible before the age of 65 if they have certain disabilities or illnesses.

You may wish to put off enrolling in Part B of Original Medicare if you are still working or have other health insurance. Most people who are still working do not put off enrolling in Medicare Part A because it is free for the majority of Americans.

Medicare Part A

Medicare Part A, also called “hospital insurance”, covers things like inpatient hospital care, hospice, home healthcare, and more.

Medicare Part A does not require most people to pay a monthly payment. This is because you’ve already contributed to the system through payroll deductions for Medicare.

Part A, on the other hand, does not cover everything and is not completely free. Before Medicare Part A kicks in and starts paying for your care in 2020, you’ll have to pay a deductible of about $1,400. Following that, you may expect Medicare Part A to cover roughly 80% of inpatient care for the remainder of the benefit term.

Medicare Part B

Medicare Part B, also called “medical insurance”, covers things like doctor’s visits, mental health services, some preventative care, and more.

For Part B, everyone pays a monthly payment. As of 2020, Part B will cost roughly $144 for people new to Medicare. Other cost-sharing payments for services, such as a deductible, copays, and coinsurance, will be required. Similarly, Part B is expected to cover up to 80% of covered services.

People who are still working or who are covered by their spouse’s health insurance plan may wish to put off enrolling in Part B. If you postpone enrollment and do not have creditable coverage, you may be required to pay a higher monthly premium as a penalty for not enrolling when you first become eligible.

Original Medicare does not cover, most prescriptions, long-term care, routine dental care or dentures, routine vision care, routine hearing care or hearing aides, routine foot care or other alternative treatments.

Medicare reimbursement for claims under Medicare A and Part B:

You will need to file a claim with Medicare for Original Medicare (Part A for hospital coverage and Part B for medical coverage) only if your doctor has delayed filing and you have exhausted all other options. Although this is an uncommon occurrence, you should be prepared.

Medicare reimbursement for claims for Part C and Part D:

There are no Medicare claims for Medicare Part C (Medicare Advantage plans) or Part D (prescription drug coverage) because Medicare already pays a specified sum each month to the health insurance plan contracted to handle your benefits. You will, however, be responsible for the Medicare Advantage or Prescription Drug plan’s cost sharing (copayments, coinsurance, and/or deductible).

You may be required to file claims with the plan, and the procedure varies each plan. If your health-care plan includes a network of providers, and you see a doctor who is part of that network, the doctor will usually file your claim for you.

Some plans allow you to see any doctor outside the network who accepts Medicare assignments. In these circumstances, you’ll almost certainly have to file your own claims. These claims are submitted to the Medicare Advantage or Prescription Drug plan, rather than to Medicare.

Medicare claims must be submitted within 12 months of the date the service(s) were rendered. If you obtained health care services on March 3, 2021, for example, your doctor has until March 3, 2022 to file a claim. Of course, waiting that long is not a good idea.

Even if you don’t expect a refund (i.e., you merely paid the doctor your half of the bill), you should check to see whether any deductibles have been applied to your account. This occurs only when Medicare claims are submitted.

If your doctor has not yet filed your Medicare claims and you are awaiting reimbursement or have a deductible to pay, you can call the doctor’s office to remind them to do so. Call 1-800-MEDICARE if it doesn’t work (1-800-633-4227; TTY users should call 1-877-486-2048). Representatives from Medicare are available 24 hours a day, 7 days a week. If all attempts have failed, you may go ahead and file the Medicaid claim yourself

n the website of the Center for Medicare & Medicaid Services, you can find Medicare forms. You can download and print CMS 1490S, Patient’s Request for Medical Payment, by searching for it on the internet. A form is also available at your local Social Security office. On the back of the form are instructions for filling it out. Call 1-800-MEDICARE for more information (1-800-633-4227; TTY users should call 1-877-486-2048). Medicare is a nonprofit organization that represents people with disabilities.

It’s vital to determine whether your doctor accepts Medicare assignments in order to be reimbursed by Medicare. You should only be accountable for the fraction of Medicare that is your responsibility if your doctor takes it. This can include copays, coinsurance, and/or deductibles.

If the doctor or other health care provider that performed the service does not accept Medicare, you may be responsible for all the charges associated with your visit.